The Facts About Retirement Income Planning Uncovered

Table of ContentsEverything about Retirement Income PlanningAn Unbiased View of Retirement Income PlanningHow Retirement Income Planning can Save You Time, Stress, and Money.6 Simple Techniques For Retirement Income PlanningIndicators on Retirement Income Planning You Should KnowSome Ideas on Retirement Income Planning You Need To Know

There are a variety of concerns that require to be responded to when you're preparing retired life earnings. 1) Determining when to retire is a key factor in intending your retirement earnings. While this inquiry might not be easy, it's crucial to weigh all of the various aspects to give you the possibility of the ideal retirement feasible.Period Certain This choice allows you to get a payment for a set number of years. Also if you pass away before the full duration of time, your beneficiaries will remain to obtain the annuity. Round figure This choice permits you to pick a single cash money repayment currently, for no additional payments.

4) When intending your retired life revenue, it's necessary to take tax obligations right into factor to consider. Inevitably, there are 3 various tax treatments in retired life. The first treatment is taxable money, which need to be reported on your tax return and is subject to tax. Instances consist of interest earned in bank accounts as well as taxable gains on stock in a brokerage firm account when you offer it.

Retirement Income Planning - Truths

The 2nd tax obligation therapy is tax-deferred. Your tax-deferred accounts are accounts where you didn't pay tax on your payment or seed money. Examples of tax-deferred accounts are 401(k)s and also IRAs. These accounts additionally grow tax-deferred, so you do not pay tax obligation as they raise in worth. Instead, when you draw money out of these accounts, your withdrawals will be exhausted as regular income.

With a tax-free account, the tax obligations were paid on the contribution, so development and also withdrawals are not strained, as long as you abide by internal revenue service regulations. Examples of tax-free accounts are community bonds, Roth IRAs, and particular kinds of money value insurance coverage - retirement income planning. With a clear income strategy that takes tax obligations right into account, it might be possible to proactively decrease your tax obligation bill throughout retired life.

All About Retirement Income Planning

This is money you're relying on accessing in the short term. retirement income planning. You'll wish to safeguard this cash from market volatility and also pick extremely conservative monetary instruments. This pail holds cash you won't require to gain access to for 4-6 years. It holds conservative financial investments that will certainly replenish the temporary container when worn down.

For some Americans, a feasible technique is to downsize their house by offering it, and then utilize a section of the gains to fund retirement. Uncle Sam has made this method job from a tax point of view.

Despite why you work, the additional income you develop will certainly also be consisted of in your strategy as it can lower the quantity of assets required to draw down for money flow.

Some Known Incorrect Statements About Retirement Income Planning

This is a her explanation fundamental income source for many check that people. When you determine to take it might have a large effect on your retirement. It can be appealing to claim your benefit as quickly as you're eligible for Social Securitytypically at age 62. However that can be a pricey move.

(FRA varieties from 66 to 67, relying on the year in which you were born.) Figure out your complete retirement age, and deal with your economic professional to explore just how the timing of your Social Protection advantage fits into your overall strategy. Pension plans utilized to be prevalent, they aren't so much anymore.

1 If you are among those people, you'll intend to consider the benefits and drawbacks of just how you take out the moneyas a swelling sum or stream of earnings. If you don't have a pension, there are other means to produce a pension-like stream of income.: A fixed revenue annuity is a contract handled by an insurer that, in return for an ahead of time financial investment, guarantees * to pay you (or you as well as your partner) a set quantity of earnings either for the rest of your life (and also the life of a making it through spouse in the case of a joint and also survivor annuity) for a set time period.

How Retirement Income Planning can Save You Time, Stress, and Money.

In enhancement, there are options to give an advantage to your heirs, if that is an alternative that is necessary to you. While each kind of annuity can use an attractive blend of features, deal with your financial professional to aid determine which annuity or a combination of annuities is ideal for you in constructing a varied revenue plan.

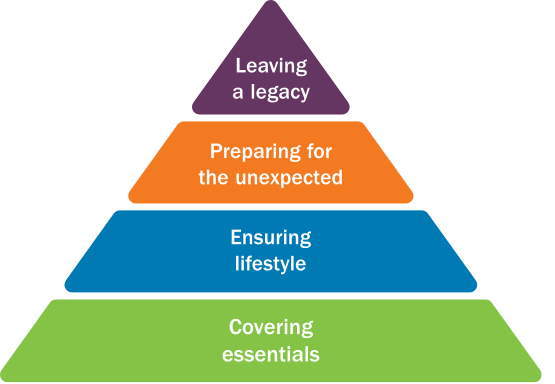

You'll desire to think about how you can pay for those enjoyable points you have actually always fantasized about doing when you ultimately have the timethings like getaways, pastimes, and also other nice-to-haves. It's a smart approach to pay for these sort of costs from your financial investments. That's since if the marketplace were to perform improperly, you might constantly reduce on several of these expenditures.

Every person's circumstance is special, so there's no one earnings approach that will work for all capitalists. You'll require to determine the loved one value of development possibility, assurances, or flexibility to help you pinpoint the approach that is appropriate this hyperlink for you in retired life.

Our Retirement Income Planning Diaries

Retired life preparation thinks about not only assets and also revenue but also future costs, responsibilities, and also life span. If you are under 50, you can add a maximum of $20,500 in 2022 to a $401(k). In the simplest sense, retired life planning is what one does to be prepared for life after paid work ends.